Study about corporate clients segment in order to deliver relevant services online

01 Case

Itaú Unibanco is the largest private bank in Brazil and one of the largest companies in the world, operating in 21 countries. The objective of Itau is to help people and businesses to have a healthy relationship with money and support them to make good financial decisions.

The bank is increasingly incorporating the digital in its way of relating to customers and wants to allow new corporate clients to contract customized services and products via website

02 Challenge

The challenge was to understand deeply our corporate customers: their needs and pains in order to best segment them and deliver relevant services online

03 My role

I lead the project. This was a big research project divided in 2 steps:

-

1 step I conducted all the research internally at the bank

-

2 step we had the help of a consultancy to help us to cover the customer interviews and analysis. I also managed the consultancy during the phase 2

04 Approach

The project had 3 pillars: Product, Customer, Analogue Markets

Project's main phases:

1 Research / 2 Analogous research / 3 Synthesis / 4 Ideation / 5 Prototype

1 Research - Looking inside the bank

Our initial approach was to look inside the bank: know the existing products for each segment of corporate clients, interviews with managers of the banking agencies to understand the current processes, restrictions and arguments of sales of the products offered.

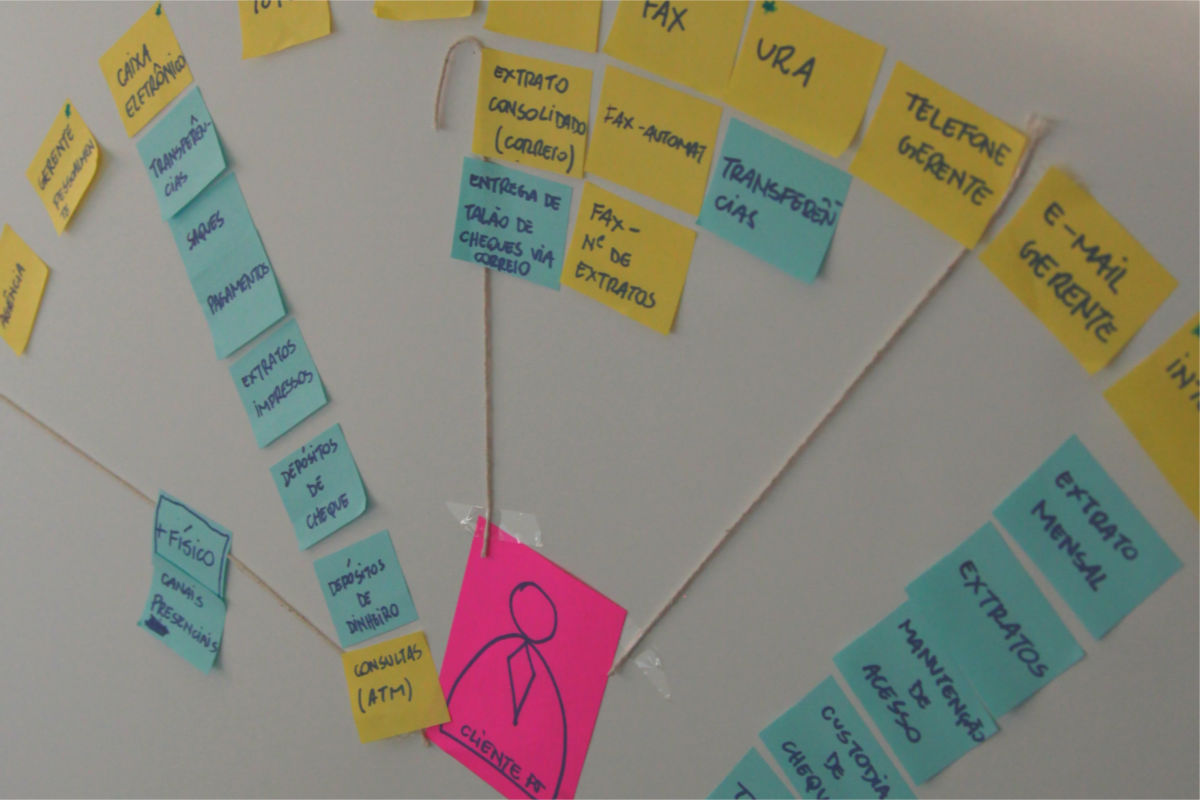

Mapping channels x services

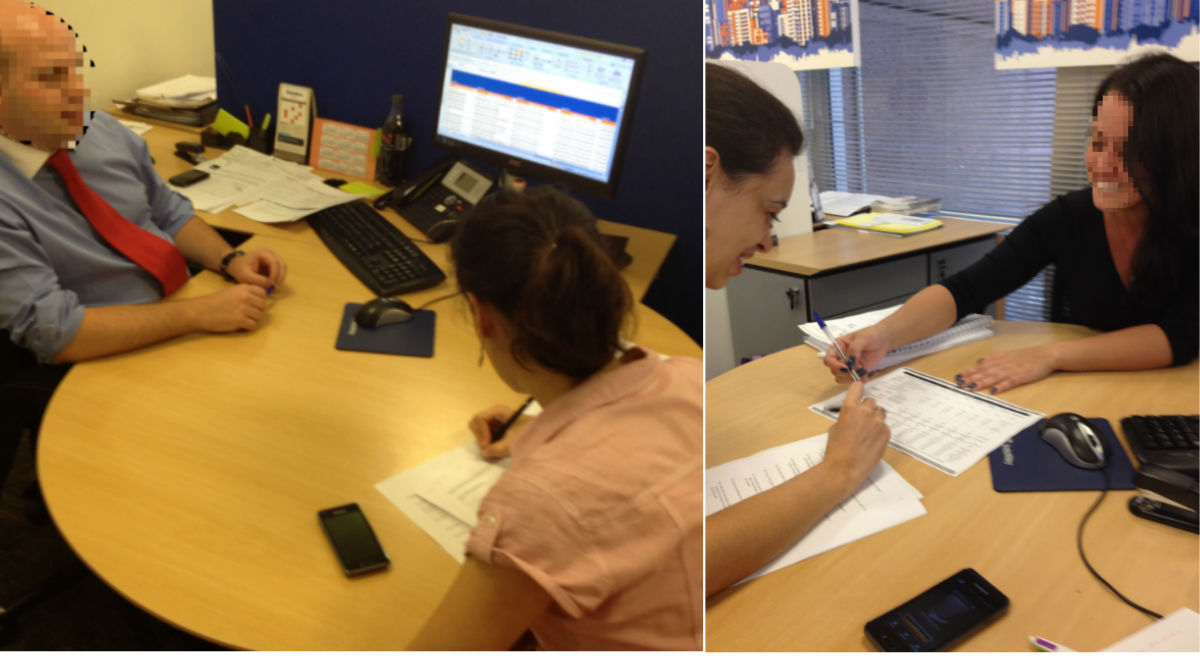

I was in charge of the research plan: from screening to conduct the interviewing. We observed the managers for a full day and we did in-depth interviews at the place where they work.

Field observation to understand bank agency managers approach to clients, how they offer services, the process, client's questions and concerns

In-depth Interviewing with managers to understand how they connect with their clients and manage their client's portfolio

1 Research - Looking outside the bank. Talking to corporate clients

At this point, we did an in-depth interview with corporate clients from different segments with different expectations and stages of their business.

We tried to understand the rational and emotional motives behind each key moment the client interacted with the bank: from awareness until the cancellation of a service.

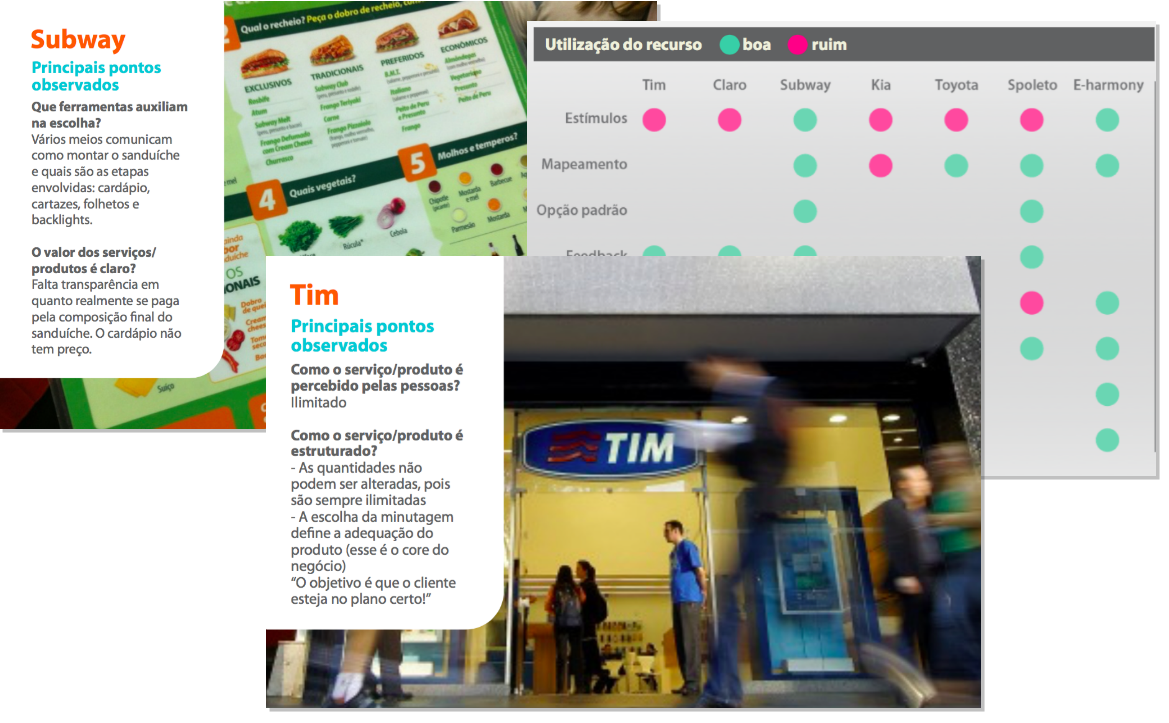

2 Analogous research

We sought for inspiration in similar markets to understand how they offered their products and how customers explored different levels of customization of a service as we as their feelings about it.

Markets that we look at: Restaurants (a la carte and self service), mobile operators with different plans, car dealerships.

3 Synthesis

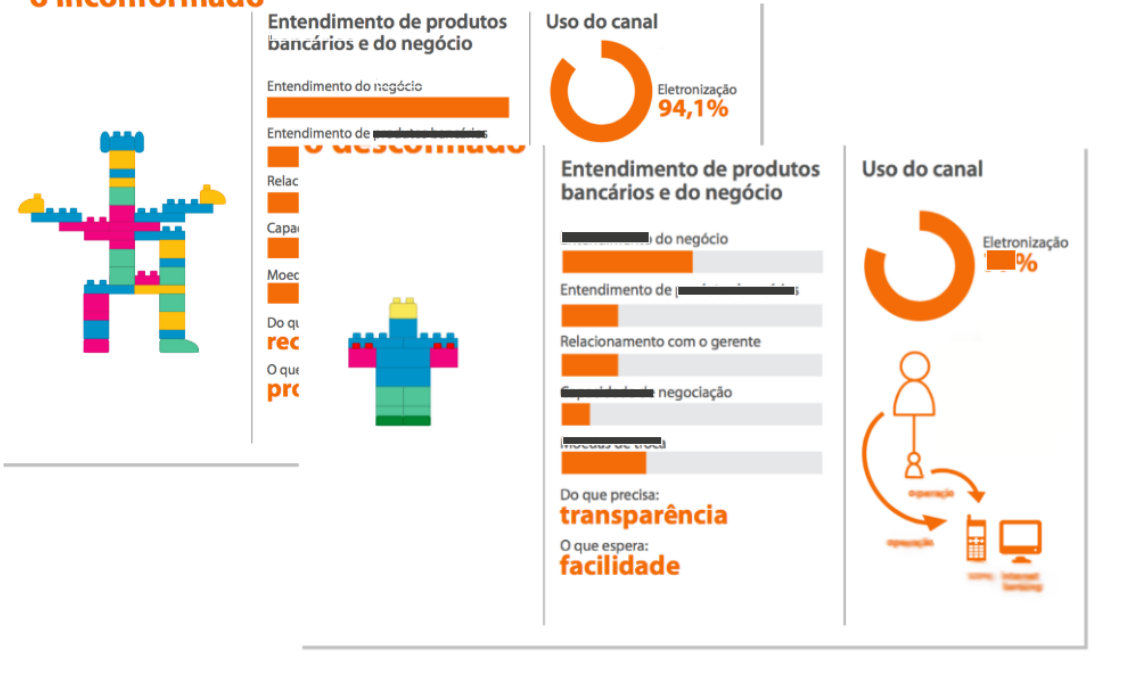

The segment of a client defines how they will relate to the bank. Each segment has a different pain and need. Therefore, it is mandatory to have the right segmentation.

There is also a fundamental differentiate among the concept of having a customized service or personalized service.By customized service we mean provide options for customers. In the other hand, personalized service is about understand who is the customer. Depending on the business segment of corporate client they may need a customized service or personalized service.

To illustrate each segment behavior and expectation, we created personas.

4 Ideations

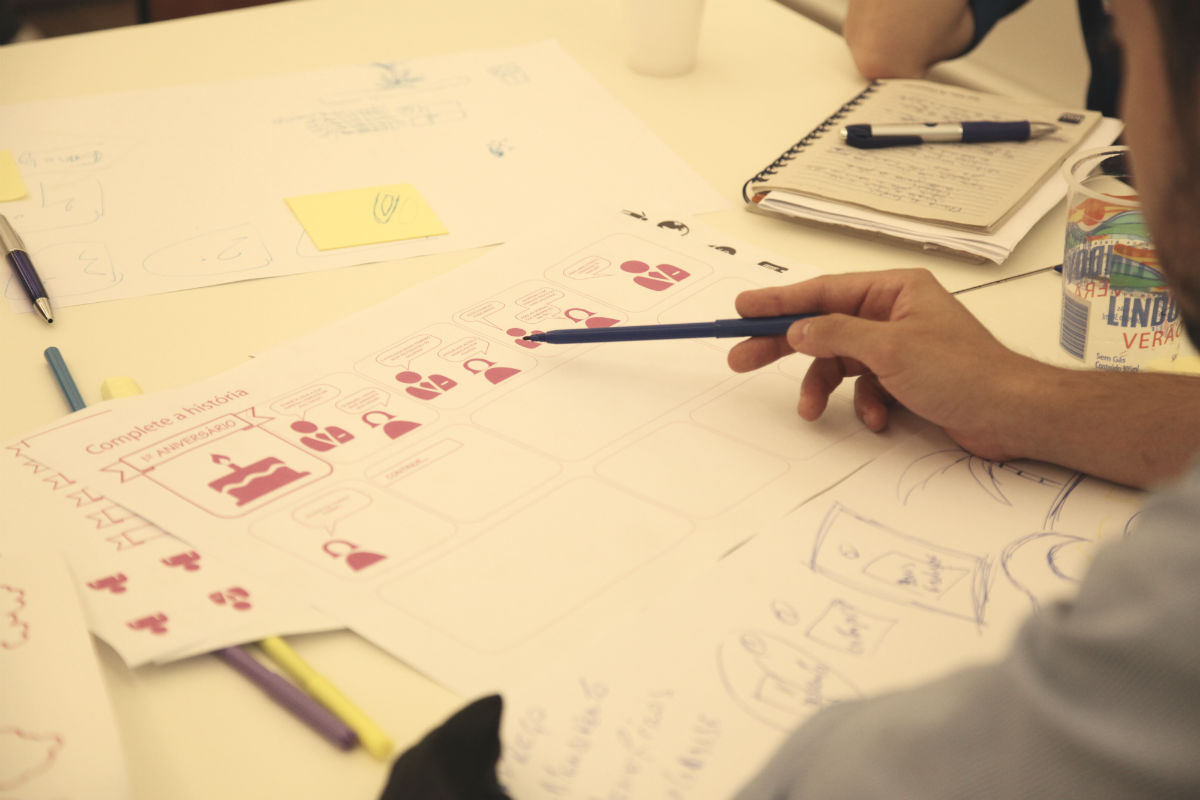

To come up with a relevant solution to our corporate clients we did a co-creation session with clients and internal team. So they help us to create the interface of this customized or personalized services for our clients.

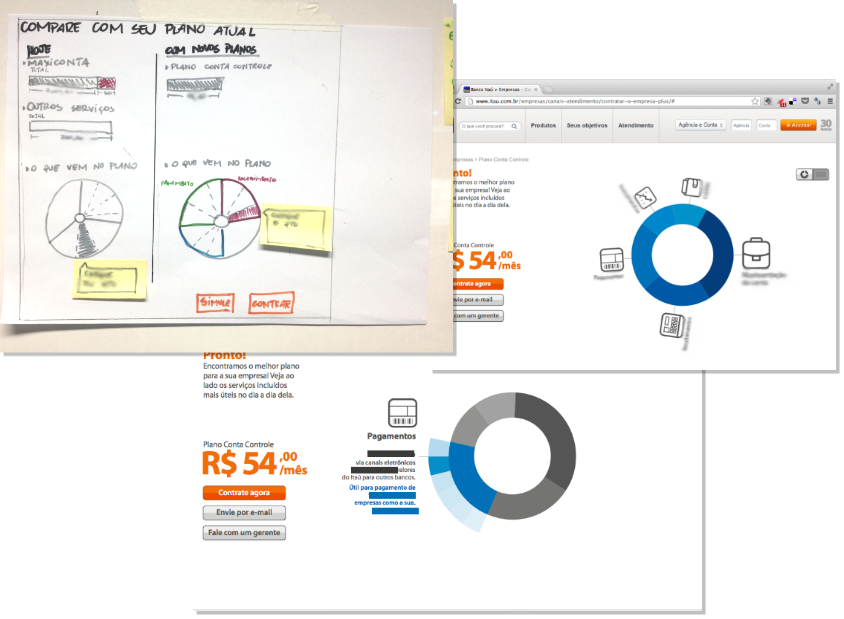

5 Prototype

As the result we first create some mockups and then we created a high fidelity prototype, so clients could simulate and customize their services.

Using the prototype we did some internal and informal usability tests in order to adjust whatever it needs.

Rapid Prototyping, test with eye tracker

*Note — The mockups contain placeholder data and the number of screens is not exhaustive